Nobody said a word for five blocks…

A few days ago, I (Porter) walked out of a dinner meeting at the Metropolitan Club of New York. I can remember every sight and sound. It all plays back in my head like a high-definition movie. This is not an April Fools’ Day joke, unfortunately. This is a true story, down to the last, incredible, detail.

It was 9:43 p.m. It was Tuesday night. It was about 45 degrees. I was with two of my closest friends and colleagues. There was no wind. Traffic was light. We took a left on Madison, heading north. We went to Club Macanudo on East 63rd Street for an after-dinner drink.

And like I said… nobody said a word.

I was in shock. It felt like I was walking away from a car accident. My adrenaline was pumping. My mind was racing. I couldn’t fully process what I had just learned… but I had never been so afraid – not like this.

At the last minute, I had been invited to have dinner with one of the most powerful men in the world. This man guards his reputation closely. For reasons that will become clear, he does not want to be named in this story. You would immediately recognize his name and you would certainly know his reputation.

His career has spanned the last 40 years and includes stints at the highest levels of the U.S. government. For the last dozen years, he has served as an advisor to the world’s wealthiest men. He sits squarely at the nexus between government policy and the country’s wealthiest and most influential people.

He invited me to dinner on the fifth floor of the Metropolitan Club. Few people outside of New York know about this club. But it’s one of the ultimate bastions of wealth and privilege in our country. Built by J.P. Morgan himself, it sits on the southeast corner of Central Park on Fifth Avenue.

Among other notable events, investing legend Warren Buffett celebrated his 50th birthday there. The most powerful and wealthiest people in the country meet there for dinner. The real policies that run our country get debated and decided there.

I was with two friends that night – our director of business development, Mark Arnold, and Erez Kalir, a well-known and successful hedge-fund manager.

Before coming to Stansberry Research three years ago, Mark was a partner at one of the largest venture-capital law firms in the U.S. He has worked on hundreds of major funding deals. He received his undergraduate degree from Duke and he has both an MBA and a law degree.

A few years ago, Erez managed around $1 billion as part of the Tiger Management group – the hedge-fund family controlled by legendary investor Julian Robertson. Today, Erez runs a small, private investment-advisory business… whose name you might recognize. (It’s called Stansberry Asset Management.*) This firm – which is separately owned and managed – licenses our name and uses our research to build portfolios for high-net-worth investors.

Erez is the smartest investor I have ever met. He received his undergraduate degree from Stanford, was a Rhodes scholar, and graduated from Yale Law School, where he was on Law Review.

You need to understand… the people I was meeting with that night were not conspiracy theorists. They are smart, experienced professionals who know the world (and the major players) of finance inside and out. They do not scare easily. They have seen panics, booms, and busts all around the world. And yet… what we learned at dinner sobered all of us and affected us in a way no other discussion in my career ever has.

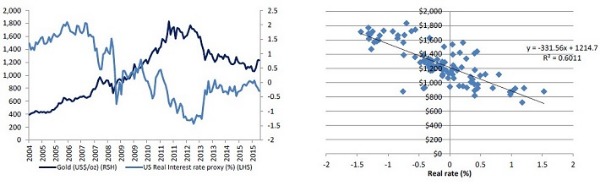

Our host – who, by the way, was scheduled to appear on national television at 10 p.m., immediately after our dinner – began the meeting by describing discussions among senior policymakers in the U.S. about the possibility that the U.S. will follow Europe and Japan into negative interest rates. You probably haven’t noticed, but despite the big rebound we’ve seen in the stock market, sovereign interest rates (as measured by the yield on the U.S. 10-year Treasury bond) have continued to fall. In the first quarter of the year, the yield fell from 2.27% to 1.77%

According to our host, among U.S. policymakers it was becoming a foregone conclusion that since Europe (one of our major trading partners) and Japan were both using negative interest rates to weaken their currencies and to avoid deflation, that it was only a matter of time before the U.S. would do the same.

The likelihood that the U.S. will implement a negative interest-rate policy (or “NIRP,” for short) is worrisome. You might have heard about this new kind of monetary policy. It’s like capitalism turned upside down. Instead of being paid to save capital, you’re forced to pay just to keep the money you’ve already earned. Negative interest rates are nothing more than government theft. Its banks literally steal from you every day that you keep your money in dollars, yen, or euros.

The dinner I attended wasn’t about these kinds of NIRP policies, though. Our host was assuming that negative interest rates would certainly occur in the U.S. The problem he wanted to talk about that night wasn’t whether NIRP would happen in America. He wanted to discuss what would happen next… and how the government could possibly put capitalism back together if all hell broke loose under NIRP.

Here’s the hypothesis: What if NIRP spread globally? What if they’re implemented around the world in every major paper currency? Think of it like dominoes. Japan has done it. Europe has done it. Sweden, too.

And last night, China became the latest major domino to fall. The overnight Hong Kong interbank offer rate (“Hibor”), which determines the rate that banks in the city have to pay to borrow Chinese yuan from each other, fell to negative 3.725% annually. Who in his right mind would want to hold yuan if it costs nearly 4% a year just to keep his money in a bank?

America is likely next. If all of the world’s major reserve currencies begin paying negative interest rates, the Federal Reserve will have to follow. Otherwise, the dollar would soar and crash our economy. So if all the major banks in the world are charging negative interest rates… where will the trillions and trillions of dollars in overnight banking deposits flee to next?

Imagine you’re the head of $300 billion reinsurance giant Munich Re. You must hold huge cash reserves so you can pay claims, should they arise. Millions of people around the world depend (and have paid for) the guarantees you’ve made to protect their homes, businesses, properties, and entire cities.And now, instead of earning interest on these reserves, your company must pay huge sums of money simply to keep your capital safe. What will the people who run firms like Munich Re… or JPMorgan Chase… or Japan’s huge Sumitomo Mitsui Banking do with their capital? How can they keep it safe in an era of negative interest rates?

And what will individuals do? Where would you put your money if Bank of America and Wells Fargo began taxing your wealth and your savings every day, instead of paying you interest? How would you keep your money safe?

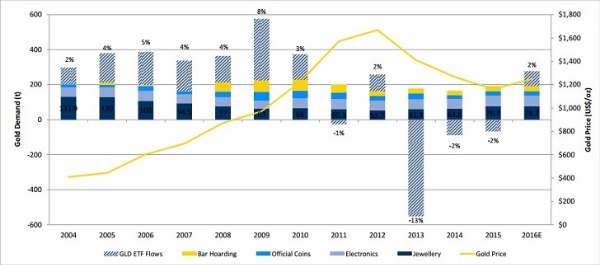

Let’s see what people are actually doing when faced with this conundrum. Munich Re is responding to negative interest rates by hoarding cash (tens of millions)… and by holding almost 300,000 ounces of gold. Media reports claim the firm has been an active buyer in the gold market. As Bloomberg News says…

Institutional investors including insurers, savings banks, and pension funds are debating whether it may be worth bearing the insurance and logistics costs of holding physical cash as overnight deposit rates fall deeper below zero and negative yields dent investment returns.

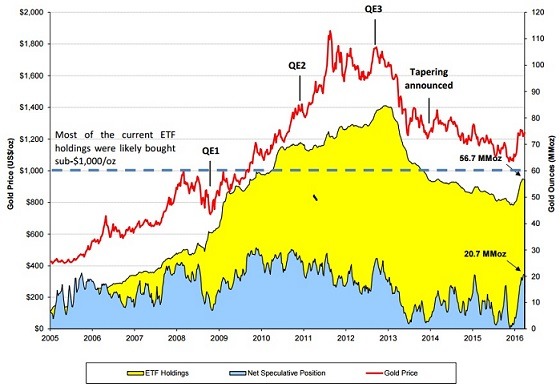

Trust me when I tell you… Policymakers in the U.S. are cognizant of this risk. This isn’t a doomsday scenario… It’s happening right now. These risks are exactly why gold has seen its biggest quarterly move higher in more than 30 years.

The run has started.

Look who is suddenly buying gold former vice chairman of the investment bank Goldman Sachs John Thornton is now running Barrick Gold, one of the world’s largest gold producers. Goldman has already purchased three tons of physical gold for its house account.

Stanley Druckenmiller – one of the most successful investors of the last 30 years and former head of the Quantum Fund – holds about 30% of his personal portfolio in gold.

The same is true across the top echelon of Wall Street’s best hedge-fund managers: John Paulson owns stakes in several gold-mining companies. David Einhorn is a huge gold bull, with more than $100 million invested in gold stocks. Paul Singer says it’s the only real money. Ray Dalio – founder of Bridgewater, the largest hedge fund in the world – says, “If you don’t own gold, you know neither history nor economics.”

I could go on, but you get the point. Billionaires are suddenly hoarding gold and expounding on its role in history. Doesn’t that make you wonder what’s really going on behind the scenes? More and more senior people in finance are buying huge amounts of gold. Why? Because of what I learned at dinner just a few nights ago…

After outlining the risks of NIRP and the inevitable run on paper currencies these policies will produce, our host at the Metropolitan Club asked us a simple question…

How will the world’s central banks regain control of the monetary system when it all finally breaks down? What will get people to stop hoarding cash, to stop buying gold, to put their money back in the banks?

He then explained there would only be one sure way to gain control of the system: To use gold. He noted that the U.S. Treasury owns more gold than anyone else in the entire world.

The details about the Treasury’s gold hoard are important to the story. So for review, the U.S. Treasury owns 248 million ounces of gold. It’s held, mostly in the form of gold bricks, at three locations: Fort Knox, West Point, and the U.S. Mint in Denver.

Also important… you should know that about two-thirds of this gold was essentially stolen from private U.S. citizens in 1933, when FDR outlawed the private ownership of gold. The right to own gold wasn’t reinstated until 1974. All of the confiscated gold was melted down into bricks. Then, in 1937, it was put on a special nine-car U.S. Army train and shipped to Fort Knox. Since then, just about the only people who have been allowed to see the gold are auditors from KPMG. No one else is allowed inside.

Our dinner host explained what would happen to this gold if NIRP policies caused a global run on paper money. And that’s when I got genuinely afraid…

The only way to re-establish credibility and regain control of the financial system in the event of a global run on paper currencies would be to re-establish the U.S. dollar’s convertibility into gold. Our host described the means for accomplishing this goal. The Fed, he said, could offer to swap all of the Treasury bonds it holds (about $2.4 trillion) for all of the gold owned by the U.S. Treasury. When you do the math, you come with a new dollar-to-gold ratio of $9,677. Roughly $10,000 an ounce.

Our host went on to describe several important nuances to how such a system would work, which goes beyond the scope of today’s Digest. I want to make sure you understand three key things I learned at this meeting…

- The first thing you must understand is the world’s system of paper money is unraveling. The only way to prevent a collapse of the banking system under the weight of outrageous sovereign debts is negative interest rates… the very thing that will spark a run on the system itself. The inevitability of this outcome is already influencing the behavior of the world’s largest banks, insurance companies, and the wealthiest investors. And they’re all going to do one thing: Buy gold.

- The second thing you should know is that as this crisis unfolds, people in and around government who understand how to use our country’s gold (most of which was stolen from citizens) will re-establish financial order. But so much money has been created out of thin air that the price of gold will have to soar (relative to the dollar) to stabilize the system after it collapses.

- The third thing you have to understand is that the government will almost surely do something to prevent you from buying gold when the panic comes. That’s why our host (a former leading government official) is buying gold now. And that’s why you must do so, too – immediately.